The US healthcare industry consists of 750,000+ companies and makes up roughly 18% of the country’s GDP1, and it is one of the fastest-growing industries. As the healthcare landscape evolves, innovative treatments emerge, and consumer behaviors change, companies are investing more to promote their products and services. It should come as no surprise that pharma and healthcare advertising are experiencing a significant uptick in spending.

According to Richard Kaskel, CEO & Managing Partner of Adfire Health, the surge in healthcare advertising spending is critical for healthcare marketers and other industry leaders to understand. As Kaskel explains, “It represents the ever-changing landscape in healthcare. At Adfire Health, we’ve seen heightened demand to reach HCPs due to a demographic shift, increased patient needs, new drug releases, and advances in medical technology.” To be competitive, organizations need to understand digital strategy.

In this article, we’ll dive into the driving forces behind the rise in healthcare advertising expenditures and examine how healthcare companies can navigate these changes.

Pharma and Healthcare Advertising Spend Rises

Digital advertising spend is increasing as healthcare organizations respond to growing trends requiring them to reach and inform an HCP population juggling more demands and a patient population expecting better care. In 2023, we witnessed a substantial surge in healthcare advertising spend, reflecting a growing commitment to improving the well-being of individuals and communities alike.

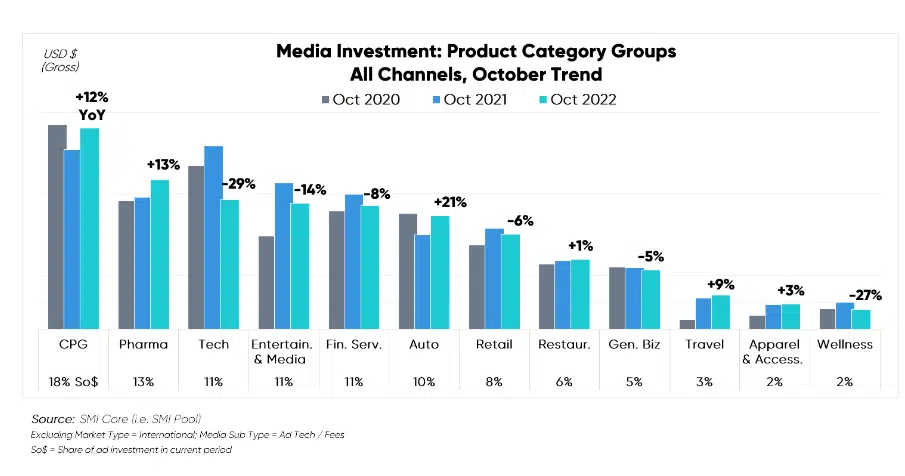

Image Source: Standard Media Index

- The pharmaceutical industry has surpassed the technology sector to become the second-largest industry in advertising spending.2

- The pharmaceutical industry’s share of total advertising spending grew from 12% to 14% in January and February 2023, compared to 2021, when it was 7% in January and 1% in February.3

- Insider Intelligence eMarketer forecasts increased digital ad spending from $15.84 billion in 2023 to nearly $20 billion in 2024.4

- The IMARC Group forecasts that U.S. healthcare advertising will grow from $22.4 billion in 2022 to $29.2 billion in 2028, with a growth rate of 4.6%.5

- The global healthcare advertising market is expected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2023 and 2028. This growth would increase the market’s value from $40.11 billion in 2023 to $52.1 billion by 2028.6

Market Trends in Healthcare

Market trends in healthcare are undergoing a rapid transformation, shaped by various factors. The U.S. aging demographic is rapidly shifting as baby boomers age, and the industry is experiencing a notable shift towards patient-centered care, emphasizing individual patient needs, preferences, and values. The growing adoption of digital health technologies, accelerated by the COVID-19 pandemic, has reshaped how healthcare is delivered.

Healthcare Industry Adapts to the Baby Boom Generation’s Needs

As the baby boomer generation ages, the healthcare industry adapts and innovates to provide quality, accessible, and cost-effective care. Born between 1946 and 1964, the baby boomers constitute a substantial portion of the population. In 2000, the Medicare-eligible population (65 years or older) in the United States numbered 35.1 million. By 2030, this number is expected to increase to 69.7 million.7

This demographic shift drives increased demand for a wide range of healthcare services, from primary care and chronic disease management to long-term care and specialized geriatric services. Healthcare providers are adapting to accommodate the unique needs of this aging population, emphasizing preventative care and strategies to promote healthy aging. The healthcare industry is responding with innovative technologies and pharmaceuticals targeted at age-related conditions and diseases.

Patients Are Expecting More from HCPs

Patient needs in healthcare are increasing as patients become more knowledgeable. Medical science and technology advances have expanded diagnostic and treatment options, raising patient expectations for the latest and most effective care. Moreover, the globalization of healthcare and easy access to medical information online empower patients to be more informed and proactive about their health. Patients now expect digitized, individualized, patient-centric care and advocate for more rapid treatments.

HCPs are Focusing on Patient-Centered Care

HCPs increasingly prioritize patient-centered care due to its profound impact on healthcare outcomes and patient satisfaction. Patient care makes up 64% of the total revenue in healthcare, and one in eight US citizens work within the healthcare industry.8

Patient-centered care recognizes the importance of tailoring medical treatment to individual patient needs, preferences, and values. By actively involving patients in their healthcare decisions, this approach enhances adherence to treatment plans, reduces the risk of medical errors, and ultimately leads to better health outcomes. Patients who feel heard and valued in their healthcare experiences tend to be more satisfied with their care, fostering trust and a positive doctor-patient relationship.

The healthcare industry’s growing recognition of the importance of patient-centered care encourages HCPs to adopt this approach, ensuring better patient outcomes and more effective healthcare delivery. As HCPs focus on providing more individualized therapies, they have become increasingly specialized. Healthcare marketers need highly targeted and personalized content that resonates with these HCP audience segments to engage them.

COVID-19 Catalyzed Digital Healthcare

The healthcare landscape has undergone significant transformation since the COVID-19 pandemic. While the industry was already moving towards telehealth and digital healthcare trends, the pandemic served as a global accelerant, amplifying the importance of digital advertising in healthcare.

In the post-pandemic era, these trends continue to gain momentum as the healthcare sector increases its investment in digital advertising to ensure sustained patient engagement and promote its services. The rapid adoption of telehealth and digital treatment solutions has created an urgent need for effective communication between healthcare organizations, their patients, and the broader public. Digital advertising emerged as a pivotal tool in educating the public about the virus and promoting these novel digital services, marking a pivotal chapter in healthcare’s digital evolution.

Healthcare Industry Responds to Market Trends

As the healthcare industry tries to keep up with the rising market demands, we are seeing a return to normalcy in FDA approvals, an increased focus on geriatric and rare disease medications, and significant advances in medical technology.

FDA Approvals Normalize After Pandemic

The year 2023 has ushered in a distinctive period for the medical community and the US Food and Drug Administration. After three years primarily focused on infectious diseases and emergency authorizations, 2023 signifies a return to normalcy. In 2020, we saw CDER approved 53 novel drugs, either as new molecular entities (NMEs) under new drug applications (NDAs) or as new therapeutic biologics under biologics license applications (BLAs).9 In 2023, the agency introduced a diverse range of regulatory decisions, highlighted by over two dozen novel drug approvals and landmark rulings for conditions that lacked previous treatments.10

Drugs Released For Aging Population

The FDA’s release of more drugs for an aging population shows a response to the rising health needs of older adults who face age-related conditions. Longer life expectancy and the desire for a high quality of life in later years have increased the demand for pharmaceutical innovations that improve health outcomes and the well-being of older adults. Here are three notable releases of new drugs in 2023:

- LecanemabTherapy for Early-Stage Alzheimer’s Disease: On January 1, 2023, the FDA granted Accelerated Approval to lecanemab (Leqembi) for adult Alzheimer’s patients, marking the second medication in a new category targeting the disease’s fundamental pathophysiology. On July 6, 2023, the FDA expanded the approval to include early-stage Alzheimer’s based on data from the phase 3 CLARITY AD trial.11

- Pegcetacoplan Injection for Geographic Atrophy: On February 17, 2023, the FDA approved pegcetacoplan injection (Syfovre) for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration (AMD, making it the first and only FDA-approved treatment for GA, based on positive phase 3 OAKS and DERBY trial data showing up to a 36% reduction in lesion growth with monthly treatment between months 18-24.12

- GSK’s Arexvy as the World’s First RSV Vaccine for Older Adults: On May 3, 2023, the FDA approved RSVPreF3 +AS01E (Arexvy) as the first RSV vaccine for individuals aged 60 and older, following a positive vote from the FDA’s Vaccines and Related Biological Products Advisory Committee, with approval based on safety and efficacy data from an ongoing trial.13

Drugs Released For Rare Diseases

In 2022, the CDER (Center for Drug Evaluation and Research) approved 37 novel drugs.14 Notably, more than half (54%) of the novel drug approvals, totaling 20, were dedicated to rare diseases, where patients often have limited or no treatment options.

The focus on rare disease drugs can be attributed to advances in biomedical research, deepening knowledge of rare diseases’ genetic and molecular underpinnings, and enabling the development of targeted therapies that address the root causes of these conditions. Additionally, the FDA’s provision of incentives, such as orphan drug designation, has encouraged pharmaceutical companies to invest in rare disease research by offering market exclusivity and tax credits. Patient advocacy groups have also played a pivotal role in elevating the visibility of rare diseases and garnering research and treatment development support.

Advances in Medical Technology

The medical device industry is also pushing to meet the current population’s rising demands, including those with the aging population who seek minimally invasive procedures. One notable trend is the increasing use of robotic surgeries for minimally invasive surgeries, with the global surgical robots market expected to reach $18.4 billion by 2027. 14

Leading-edge advancements, such as telemedicine, wearable health devices, and AI-powered diagnostics, are becoming progressively integral in enhancing patient care. The market for remote patient monitoring devices is set for substantial growth, with an estimated value of $8.1 billion by 2030, particularly in managing chronic conditions and expanding telehealth services.14 Currently, 60% of healthcare organizations have embraced IoT within their facilities, and more organizations continue to utilize this technology. Nearly half of companies (47%) are poised to expand their utilization of connected health devices.15

Additionally, the use of artificial intelligence and machine learning in medical devices is growing, with the global AI/ML medical device market projected to reach $35.5 billion by 2032, driven by increased demand and various therapeutic applications.14 The 3D printing of medical devices is rapidly evolving, offering innovative solutions in areas such as surgical planning, training, and orthotics, with the market expected to reach $5.9 billion by 2030, supported by its extensive adoption within the medical industry.14

Competing in the Healthcare Industry Requires HCP Engagement

In the move towards digital healthcare, where telemedicine and remote patient monitoring are becoming mainstream, healthcare organizations, including pharmaceutical and medical device companies, must engage HCPs digitally. This engagement is essential for healthcare organizations to align with evolving market trends that require them to promote, educate, and collaborate with HCPS on adopting these drugs and technologies so they can effectively reach and serve patients while maintaining quality care standards.

The Healthcare Industry is Moving to Digital

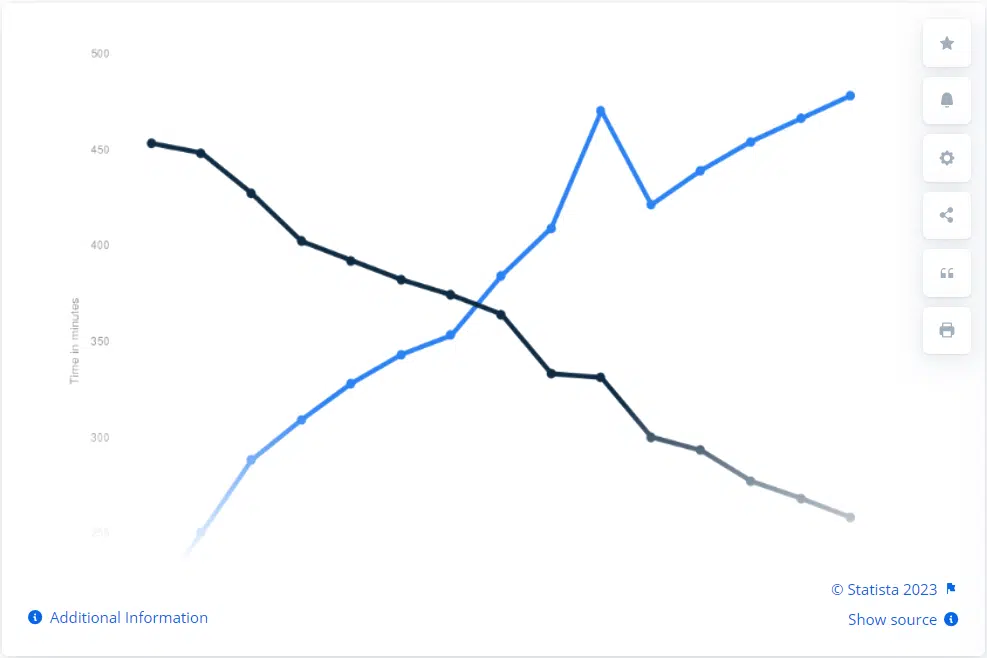

The healthcare industry is transitioning toward digital platforms, engagement, and distribution. The extensive reach and precise targeting capabilities of digital media, the growing online presence of healthcare professionals and patients, and the rapid adoption of telehealth and digital healthcare services are driving this shift. Take this graph, for example. It illustrates the decline in consumer time spent on traditional media (print, broadcast television, radio, etc.) and the increase in time spent on digital media (online streaming services, social media) from 2011 to 2025 (projected).

Image Source: Statista

Engage HCPs with Handcrafted Audiences

A strategic digital advertising approach is necessary to reach and influence the healthcare industry’s key decision-makers effectively. HCPs are responsible for patient care and treatment decisions, making their engagement pivotal in promoting healthcare products, services, and solutions. Providing educational content aids in building trust and positioning your brand as a valuable resource for HCPs striving to stay updated with the rapidly evolving healthcare landscape.

Healthcare organizations can elevate the effectiveness of their advertising by utilizing a segmented database capable of identifying HCPs based on license type, specialization, location, and other relevant factors. This customized approach can be strengthened with retargeting and behavioral strategies, ensuring your brand remains top-of-mind for HCPs.

At Adfire Health, we work with healthcare marketers to create optimized, highly effective, data-based digital engagement strategies. With Thumbprint™, our segmented data ecosystem of over 8.2 million healthcare professionals, we can offer nationwide 1:1 engagement and access to healthcare professionals.

We bring our years of hands-on experience to every new campaign and work with you to get the best results possible. Contact us to learn more about what we can do for your business.

Sources:

- Healthcare statistics for 2021: Policy advice. Healthcare statistics for 2021 | Policy Advice | Policy Advice. (n.d.). https://policyadvice.net/insurance/insights/healthcare-statistics/

- U.S. SMI Core Release Note – October 2022. (n.d.). Standard Media Index. Retrieved October 11, 2023, from https://www.standardmediaindex.com/insights/u-s-smi-core-release-note-october-2022/

- In 2021, the healthcare and pharmaceutical industry spent nearly $14B on digital advertising. According to recent projections, the industry’s digital ad spend in the U.S. is expected to reach over $19B by the end of 2024. https://www.statista.com/statistics/235966/us-healthcare-and-pharmaceutical-industry-online-ad-spending/

- US Healthcare and Pharma Digital Ad Spending: Adjusting to the New Normal in Digital Engagement. (n.d.). On.emarketer.com. Retrieved October 11, 2023, from https://on.emarketer.com/Report-20220912-MiQ_New-Bus-Reg-Page

- US Healthcare Advertising Market Size, Share & Trends 2022-27. (n.d.). Www.imarcgroup.com. https://www.imarcgroup.com/us-healthcare-advertising-market

- ltd, M. D. F. (n.d.). Healthcare Advertising Market Size, Trends, Growth | 2022 to 2027. Market Data Forecast. https://www.marketdataforecast.com/market-reports/healthcare-advertising-market

- The Baby Boomer Effect and Controlling Healthcare Costs | USC Online. (2019, May 16). USC EMHA Online. https://healthadministrationdegree.usc.edu/blog/the-baby-boomer-effect-and-controlling-health-care-costs/#:~:text=In%202000%2C%20the%20Medicare%2Deligible

- Stasha, S. (2020, July 29). The State of Health Care Industry (2020). PolicyAdvice. https://policyadvice.net/insurance/insights/healthcare-statistics/

- Research, C. for D. E. and. (2021). New Drug Therapy Approvals 2020. FDA. https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/new-drug-therapy-approvals-2020

- Research, C. for D. E. and. (2023). Novel Drug Approvals for 2023. FDA. https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2023

- Meglio, M. (2023). FDA Grants Traditional Approval to Lecanemab as Therapy for Early-Stage Alzheimer Disease. Www.neurologylive.com, 6. https://www.neurologylive.com/view/fda-grants-traditional-approval-lecanemab-as-therapy-for-early-stage-alzheimer-disease

- FDA Approves Pegcetacoplan Injection for Geographic Atrophy. (2023, February 17). HCP Live. https://www.hcplive.com/view/fda-approves-pegcetacoplan-injection-geographic-atrophy

- FDA Approves GSK’s Arexvy as the World’s First RSV Vaccine for Older Adults. (2023, May 3). ContagionLive. https://www.contagionlive.com/view/fda-approves-gsk-s-arexvy-as-the-world-s-first-rsv-vaccine-for-older-adults

- Roundtable: Medical Device Industry Trends 2022. (2022). Plexus.com. https://www.plexus.com/en-us/current/articles/medical-device-industry-trends

- Research, C. for D. E. and. (2023). New Drug Therapy Approvals 2022. FDA. https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/new-drug-therapy-approvals-2022